Many people are getting into legal sports betting are wondering do I have to pay taxes on my winnings? Well, yes. Yes, you do. Whenever you win a substantial amount of money at legal betting sites or tribal casinos or racetracks in the United States, that facility makes sure you pay taxes on those winnings because it is considered as income. You've got to fill out forms, submit records, and open yourself up to the IRS, so it's always a good idea to keep your finances in order, especially if you're going to make betting a big part of your life. That said, there are certain situations where most folks aren't going to pay taxes on their winnings. These, for a variety of reasons, are essentially impossible to be accounted for by the IRS or any other government agency.

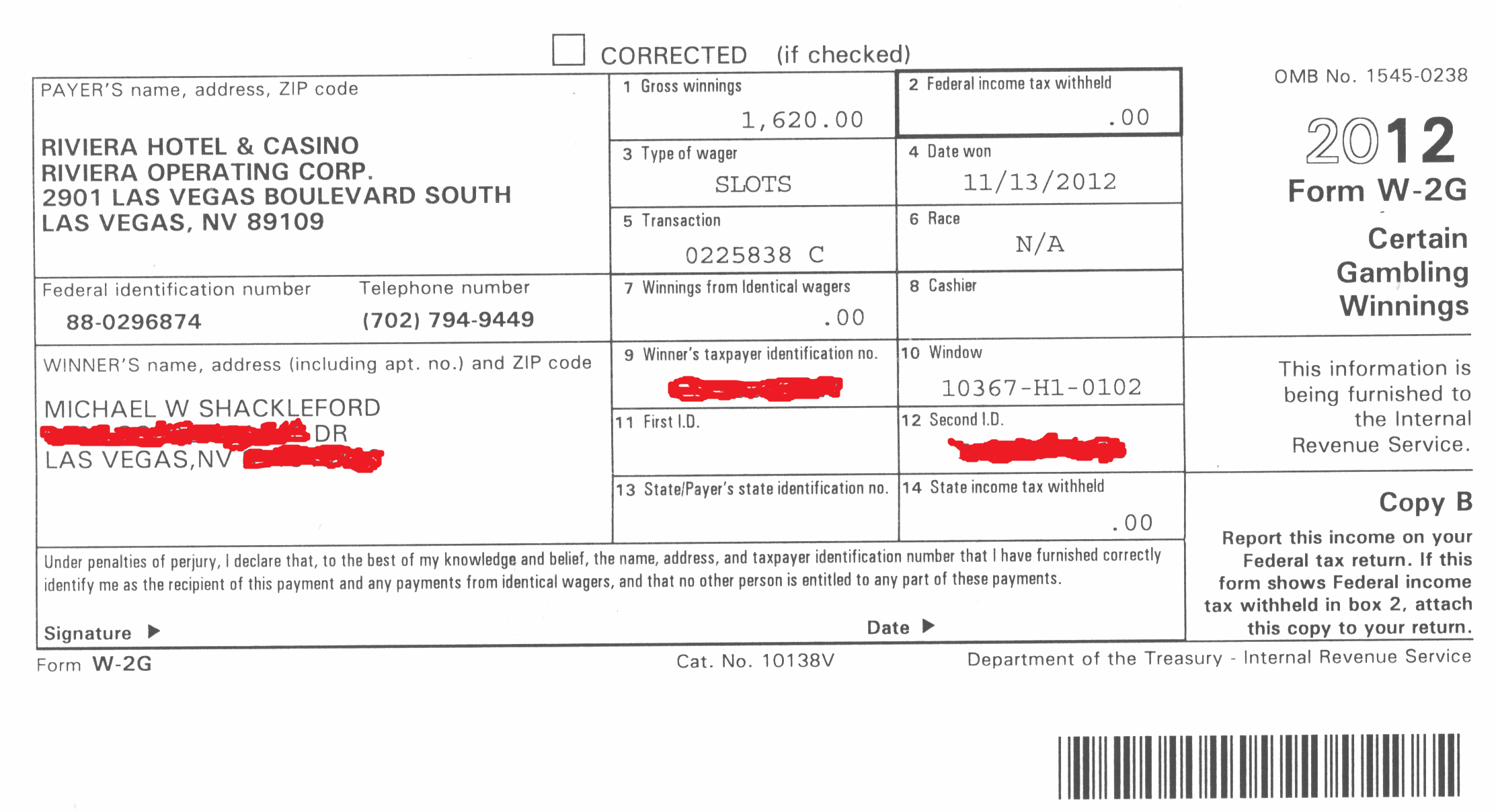

Oct 23, 2020 I'll cut right to the chase: yes, you do need to pay federal taxes on gambling winnings in the United States. This is especially true when you net a big win and receive a W-2G form. According to the IRS, a gambling establishment should issue a W-2G when you win an amount that's subject to federal income tax withholding (24% of win). Even if you do not receive a W-2 form, you're required to report all gambling winnings, paying tax on the income. However, you can also report your losses, offsetting the amount that you owe. Most states tax all income earned in their state, regardless of your residency. In addition, your resident state will require you to report the winnings, but will offer a credit or deduction for the taxes already paid to a non-resident state. Turbo Tax will handle all this for you. If you are old enough to go to one of our recommended online offshore sportsbooks to make a bet on your favorite teams, that means you are old enough to pay your taxes. We use offshore sportsbooks and we report our winnings to the IRS. You will just end up paying more if you do not pay your taxes like you should if you don't do things properly. The gambling institution is required to withhold 24% of your winnings as federal withholding tax, down from the previous 25% under the tax reform law. At tax time, you'll receive Form W-2G for all reported winnings showing the amount you won and the taxes withheld.

For example, let's say you win about $15 on a horse bet or $10 at a poker game with your friends. You are supposed to report that. Nobody does. When bets are cash in and cash out, people tend to treat their winnings like finding money. That works well enough for modest and small payouts. Naturally, the larger your haul, the bigger the chances are that the government are going to catch on to what you are doing. Banks have to report deposits of more than $10,000 to the government, but even those banks will generally respect your privacy when you're putting in smaller amounts. Still, if you don't report all of your winnings, there's a very real chance that tax season could hurt. To prevent that, you need to pay taxes on your winnings.

Do I Have To Pay Sports Betting Taxes?

Yes. Many people consider online sports betting at overseas sportsbooks to be a kind of tax-free loophole. They believe that just because you are going to an offshore sportsbook and not using a state-licensed sportsbook, you can just not pay your taxes because it is not state regulated. That's not true. You are expected to pay your sports betting taxes along with all of your other winnings. By law, if you're an American citizen or US resident, you have to pay taxes on all of your income, regardless of how you've earned it. Obviously, that includes sports betting taxes. There are many people who make a living just off of sports betting. They must pay their taxes as well because that is their income. Even though online sportsbooks are based in other countries and handle payouts from foreign banks, American tax law applies to you. And if the government knows you've got unreported income, they will come for it and leave with even more than you allegedly 'owed.' It's just not worth the headache.

However, most online sportsbooks will not report your winnings to any US authority, nor will they help you file your winnings in any taxable form. They also will not parse your sports betting taxes for your convenience or even withhold any money for that purpose. The nuances of IRS regulations represent too much of a risk for any online sportsbook to speak on directly, so they rightfully leave it entirely in your hands, exactly where it belongs. And as a sports bettor, that's where you should want it. If you are old enough to go to one of our recommended online offshore sportsbooks to make a bet on your favorite teams, that means you are old enough to pay your taxes. We use offshore sportsbooks and we report our winnings to the IRS. You will just end up paying more if you do not pay your taxes like you should if you don't do things properly.

Closest casino to palm springs airport. Do Most Online Gamblers Pay Taxes?

The consensus is that most online gamblers do not pay taxes on their winnings. In fact, only a tiny percentage seem to, and these are likely high rollers or otherwise heavily scrutinized individuals. For the most part, sports betting taxes go completely unpaid. But the government is working to change that. Ever since the Professional and Amateur Sports Protection Act (PASPA) was overturned, more and more states are formally legalizing sports wagering. That means that more taxes are being paid for when you make a bet and if you have made a large amount of money in winnings. The government is trying to bring offshore sports betting revenue back to the US. But there are plenty of states that do not have regulated sports betting. Just because that is true and a large percentage of gamblers don't pay taxes, that doesn't mean we are going to advise you to do the same. Just pay your taxes on your winnings like normal and everything should be fine.

Where Can I Pay My Sports Betting Taxes?

The IRS has provided Form W-2G: Certain Gambling Winnings,' to help you organize and pay all your gambling and sports betting taxes. Visit the link to download the form and view instructions on how to fill out and turn in all the necessary paperwork. If you need more help to organize your files, visit IRS IRS Topic 419.) The IRS policy on gambling taxes may change at any time, so please make sure to always use the most up-to-date versions of all requisite forms. If your individual state has a separate income tax, please refer to your local tax code for more information about gambling and sports betting taxes. Just remember that it is completely your responsibility to pay your sports betting taxes, especially if you are making a living off of it. It will be a huge pain for you if you are caught not paying your taxes.

- COUNTRY

- LEGAL SPORTSBOOK

- PLAYERS ACCEPTED

- RATING

- MOBILE?

- MORE INFO

- VISIT

- BetOnline Sportsbook

- Accepts U.S. Players From All 50 States

- Bovada Sportsbook

- No Players In DE, MD, NJ, or NV

Do You Pay Taxes On Online Gambling Winnings No Deposit

- SportsBetting Sportsbook

- Accepts U.S. Players From All 50 States

- MyBookie Sportsbook

- Accepts U.S. Players From All 50 States

Taxes On Online Gambling Winnings

- BetDSI Sportsbook

- Accepts U.S. Players From All 50 States

- BetOnline Sportsbook

- Accepts U.S. Players From All 50 States

- Bovada Sportsbook

- No Players In DE, MD, NJ, or NV

Do You Pay Taxes On Online Gambling Winnings No Deposit

- SportsBetting Sportsbook

- Accepts U.S. Players From All 50 States

- MyBookie Sportsbook

- Accepts U.S. Players From All 50 States

Taxes On Online Gambling Winnings

- BetDSI Sportsbook

- Accepts U.S. Players From All 50 States

- 5Dimes Sportsbook

- Accepts U.S. Players From All 50 States